Article updated on 06/10/2023

The payslip is, for many people, difficult to interpret. The issue is even more important for business leaders who do not speak French.

The payslip is a proof of payment that the employer must provide to the employee. The mentions which appear on it are fixed by the law. It allows to calculate the following main elements:

- The total gross remuneration

- The various taxes and contributions withheld from the employee and remitted by the employer to the organizations concerned

- The amount withheld from the withholding tax of the income tax

- The net sum to be paid to the employee

- The count of paid holidays remaining to be taken by the employee

- The social net amount corresponding to the income that beneficiaries of the RSA or activity bonus must declare to calculate their benefits

The payslip must contain the following information:

- The identity of the employer: name, address, Siret number, APE or NAF code

- The identity of the employee: name, position, level or hierarchical coefficient

- The title of the applicable collective agreement

- The period and number of working hours: with a distinction between hours at the normal rate and overtime or, when applicable, the nature of the basis for calculating the salary

- The gross salary of the employee

- The amount of social contributions (health, accidents at work and occupational disease, retirement, family and unemployment)

- The total amount of exemptions from social security contributions

- The nature and amount of “salary accessories” (bonuses, benefits in kind, professional expenses, etc.)

- The nature and amount of other payments and deductions, in particular the payment of home-to-work transport costs

- When a period of annual leave is included in the pay period in question, the date and amount of the paid leave indemnity

- The net amount payable before income tax, the amount of withholding tax deducted

- The annual accumulation of net taxable amounts serving as a basis for calculating the withholding tax as well as the annual accumulation of the amounts of income tax withheld at source

- Net amount of exempt additional and/or overtime hours as well as the annual cumulative amounts of exempt additional and/or overtime hours

- Net remuneration

- Social net amount: This is the amount of net income after deduction of all compulsory social security contributions

- The date of payment

- The total amount paid by the employer (remuneration and contributions payable by the employer)

- The amount corresponding to the abolition of unemployment and sickness employee contributions

- The mention of the section dedicated to the payslip on the service-public.fr website

- The statement indicating that the payslip must be kept indefinitely.

In return, certain information should not appear on the payslip: these are the statements relating to the exercise of the right to strike or to a possible employee representation activity.

Delivery of the pay slip to the employee: The payslip is delivered at the time of payment of the salary, by hand, post, or in electronic form. Except in specific cases, the employer cannot require any formality of signature or signature by the employee, apart, possibly, from that establishing that the sum received corresponds to the net amount appearing on this slip.

When the employer carries out a dematerialized transmission, they must inform the employee of the conditions under which the employees can access their payslip. The employee may object, at any time, to electronic transmission if they notify the employer of their refusal.

Contestation of the pay slip by the employee: The employee has 3 years after submission of the payslip to contest its amount or its accuracy with the employer or the labor court, even if they have accepted without reservation.

They can contest the amount of salary, the contributions deducted, the number of worked hours, the days of paid leave, professional qualification, the collective agreement mentioned, etc.

In the absence of submission of the payslip, the employer may be fined an amount of up to €450 per non-submitted or irregular payslips. In addition, the employee will be able to obtain damages for suffered damages as well as regularization.

The social net amount corresponds to the amount of salaries to be declared to be entitled to the RSA and the activity bonus (starting from July 1st, 2023).

The social net amount is used to calculate the RSA and the activity bonus among other social funds possible. It allows the people concerned to know the amount of salary or replacement income to declare in order to benefit from the RSA and the activity bonus. Recipients will be able to locate it easily and without needing to calculate the correct amount to declare.

Ultimately, employers and social protection organizations will have to declare this information directly to the family allowance funds (CAF) or to the agricultural social mutual funds (MSA), so that they can declare it directly on the applications and quarterly declarations of resources.

It will be easier for the recipient as these documents will be pre-filled like the tax return.

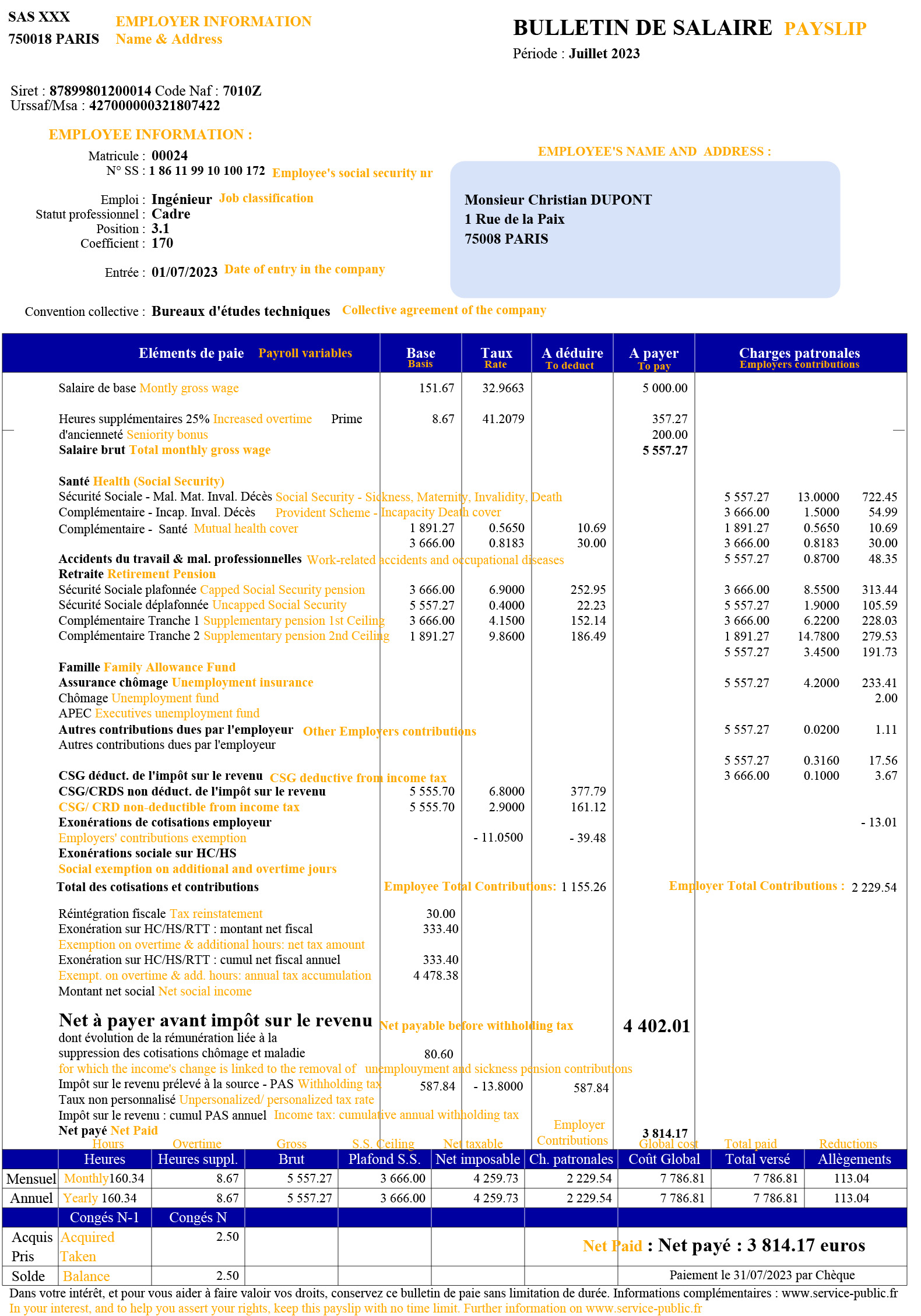

Thus, to summarize, we reproduced below a French payslip on which we added an English translation of the keywords in orange.

Obviously, you can contact us for any question on this subject!