Since 2012, foreign commercial companies having a branch in France must file each year, at the registry of the commercial court of the place where they are registered, the accounting documents that they have drawn up, have checked and published in the country where they have their registered office (Commercial code art. R 123-112, paragraph 1). This deposit must be made within the time limit provided for by the law of the country where the company has its registered office (Commercial code art. R 123-112, paragraph 2).

We will first see which documents must be filed by foreign companies with the registry of the commercial court, then we will observe what are the particularities concerning companies incorporated under foreign law during this filing.

I. The formalities to be completed when filing accounts

The reasons for depositing accounts

Here are the reasons given on the Infogreffe website:

- “the filing formality aims to present statements, drawn up regularly and sincerely, reflecting, at the closing date of each financial year, a faithful image of the assets, of the financial situation and accounting results of the activity of these companies. The comparison from one financial year to another of the data of these documents makes it possible to appreciate the evolution over time, and thus, in particular, to estimate the solidity of the companies concerned, in other words their short, medium or long term solvency.“

- “In practice, the filing formality represents the essential instrument of minimum information on companies and therefore an essential decision-making tool serving the complementary interests of any person directly or indirectly interested in the operation of the activity of these companies (managers; partners; investors; administrations; creditors such as bankers, suppliers; customers; competing companies; commercial courts and possibly, other judicial authorities responsible for the prevention and treatment of business difficulties).”

Companies concerned by the filing of annual accounts

They are:

- Multi-member limited liability companies (SARL);

- Joint-stock companies;

- General partnerships (SNC) of which all the partners are themselves:

- SARL or joint stock companies;

- SNC or simple limited partnerships (SCS) all of whose partners are SARLs or joint-stock companies;

- foreign companies assimilated to SARLs or joint stock companies;

- Liberal practice company (SEL);

- Agricultural cooperative societies;

- “European Companies” (SE);

- Commercial companies whose head office is located abroad and which have opened one or more establishments (branches) in France.

Annual social documents to be submitted

Companies must file, by mail or by hand, with the clerk of the commercial court, the following documents:

- The annual accounts;

- The profit allocation proposal submitted to the meeting and the allocation resolution voted on;

- If applicable, the auditor’s report;

- If applicable, the consolidated accounts, the group management report and the auditor’s report on the consolidated accounts.

Companies which fall under the category of micro-enterprises can, if they wish, declare that the annual accounts that they file are not made public to third parties. This concerns companies which do not exceed, for the last closed financial year, two of the following three thresholds: € 350,000 in balance sheet total, € 700,000 in net turnover and 10 employees.

Companies that fall under the small business category cannot disclose their income statement. The companies concerned are those which do not exceed, for the last closed financial year and on an annual basis, two of the following three thresholds: € 6 M of balance sheet total, € 12 M of net turnover and 50 employees.

The deposit of these documents must be carried out in the month following the approval of the accounts.

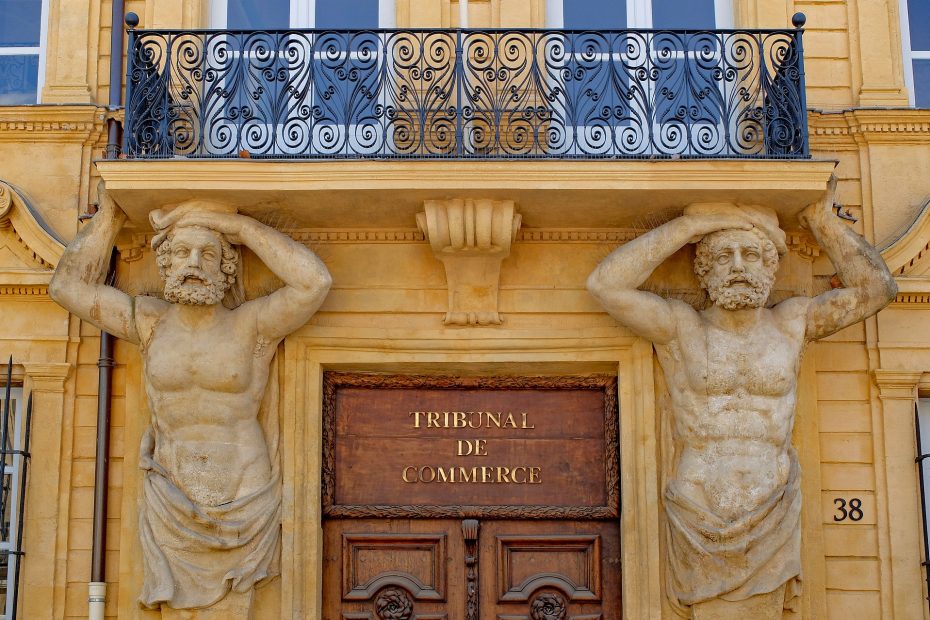

II. Special features relating to foreign companies

We have listed below some particularities relating to the filing of accounts by foreign companies, but it should be noted that the European directive 2013/34 / EU is still very little known and that it is difficult to date to obtain information on its practical application.

These particularities relate to the following points.

Documents to be sent to the clerk of the commercial court

We note first of all that article 123-112 of the Commercial Code indicates that the foreign company is required to file annually “the accounting documents that it has established, has checked and published in the State where it has its headquarters“.

The documents filed will not necessarily be identical to those listed above (chapter I-1), but that they will correspond to those that the legislation of the country of the company’s headquarters requires have it checked and published.

But we can assume that the balance sheet, the income statement, the appendix and the auditor’s report are published in the majority of developed countries.

In addition, the documents filed must be translated into French and the certified copies by the legal representative of the company or by the person having the power to bind the company in France (this person was designated at the time of registration establishment in France).

The place of filing of documents

Branches must file annual accounts with the clerk of the commercial court of the place where they are registered.

However, when the foreign company has opened several establishments in France, it seems, according to the directive UE 2017/1132 article 33, that the accounts can be filed with the clerk of the commercial court on which one of the branches chosen by the company depends.

Compliance of documents with Directive 2013/34 / EU

The disclosure obligation relates to the company’s accounting documents which have been drawn up, checked and published in accordance with the legal requirements of the state where the company has its registered office.

When these documents are not drawn up in accordance with Directive 2013/34 / EU or in an equivalent form, the commercial court may require the filing of accounting documents relating to the activity of the French establishment. This rule is valid in all European states.

Deadline for filing documents

Unlike French companies, which in principle have the obligation to file their accounts within one month of the date of the annual general meeting, for foreign companies the deposit must be made within the time limit provided for by the country’s legislation where the company has its registered office (Commercial code art. R 123-112, paragraph 2).

Penalties in the absence of filing

It seems that in the event of failure to file the required accounting documents with the registry, no criminal penalty is applicable (this seems to apply only to the list of compulsory commercial information). However, in view of article L123-5-1 of the Commercial code, the injunction procedure could be applied: “At the request of any interested party or the public prosecutor, the president of the court, ruling in summary proceedings, may order under penalty the manager of any legal person to file documents and deeds in the trade and companies register to which the latter is required by legislative or regulatory provisions.

The chairman may, under the same conditions and for the same purpose, appoint a representative responsible for carrying out these formalities”.

We remain of course at your disposal if you need further information: you can contact us!