As every month, the Solidarity Fund for companies particularly exposed to the Covid-19 crisis is undergoing significant changes. The end of the confinement as well as the new curfew measures have led the government to adapt this mechanism, and as usual, certain provisions are still being modified. Please find below the main changes, as well as an explanatory diagram giving you the keys to identify the support to which you are entitled.

> Conditions of access to the scheme

For the December 2020 support, companies that have been banned from receiving the public or that fall within the S1 sector are no longer subject to the maximum threshold of 50 employees. If this threshold is exceeded, the company loses the possibility of benefiting from the support scheme.

(NB: it is however specified that in the case of a group, this threshold applies to its level and not to that of the company).

The fact that corporate officers have a full-time employment contract on the first day of the month is no longer an exclusion criterion. Please note that this criterion is retroactive for the months of October and November 2020.

Likewise, tax debts no longer cause the Solidarity Fund to lose its benefit if one of the following conditions is met :

- The debt is paid on the day of the application;

- The debt is the subject of a legal action in progress on 1st September 2020;

- The debt is less than 1,500 euros.

This provision also applies retroactively for the months of October and November.

> Amount of assistance

This is the element that has been substantially modified by the new decree. Indeed, in addition to the usual ceilings of 10,000 or 1,500 euros, the company will be able, if it is more advantageous for it, to benefit from an aid representing a percentage of the 2019 monthly turnover or its decrease. As with previous Solidarity Funds, it is possible to take as a reference the turnover for the month of December 2019 or the average monthly turnover for 2019.

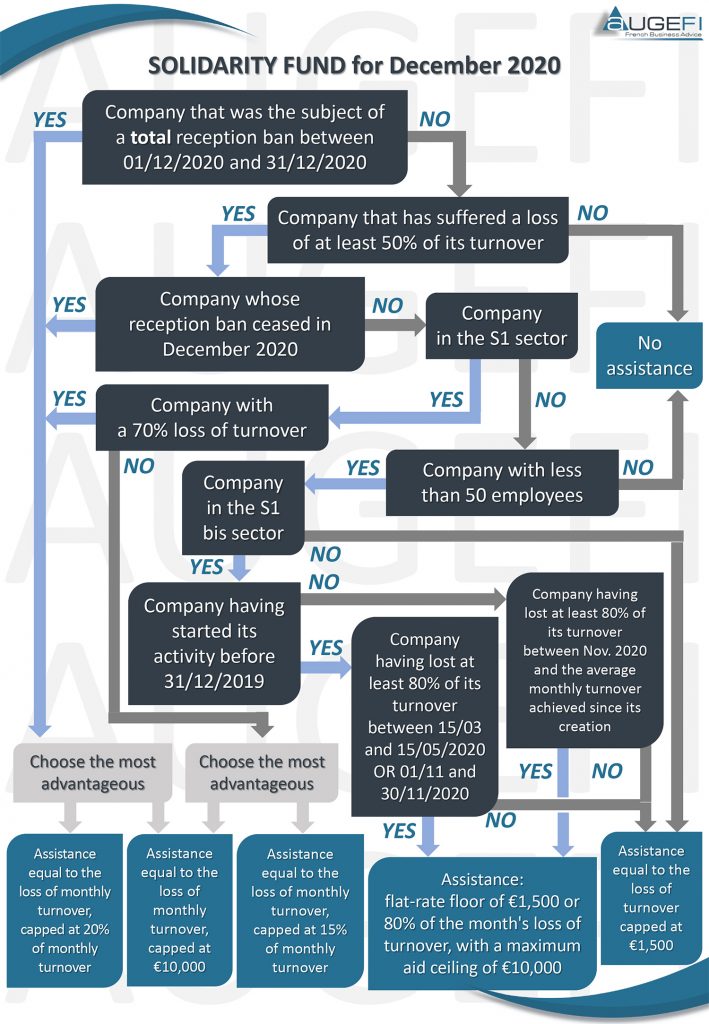

The percentage of support and the base will vary according to several criteria; therefore, we refer you to our diagram below summarising all possible cases (click here if you want to download this diagram).

Also, you can find here the updated list of sectors S1 and S1 bis to allow you to identify in which situation you find yourself.

> Some general details for all these aids

- As is the case every month, the amounts of the Daily Social Security Allowances or retirement pensions must reduce the amount of this assistance.

- The overall amount of aid allocated to the company may not exceed 200,000 euros for December 2020; in the case of a group of companies, this support ceiling is assessed at group level.

- Distance selling and take-away sales: in its initial version, the decree specifies that these must be included in the December turnover to determine its variation. In his televised speech on 14 January 2021, the Minister of the Economy and Finance Bruno LEMAIRE specified that these operations were to be excluded in the end. However, the amending decree has not yet been published.

> Terms of the request

The request for help must be made in your particular space on the impots.gouv.fr platform as every month. Also, for more explanations on this process, we refer you to our previous presentation tutorial, to be found at the top of our Covid-19 webpage in the “Tutorials & Schemes” tab.

> Explanatory scheme of the Solidarity Fund for December 2020

If you have any further questions, please do not hesitate to contact us!