In order to accompany you through this complicated period, we would like to explain to you the essential points of Decree No. 2021-316 of 25 March 2021 relating to the arrangements for settlement plans and partial remissions of debts for social security contributions constituted in the context of the Covid-19 health crisis. This decree, which you will find here, is applicable since 26 March 2021.

The public concerned is: private sector employers, self-employed workers (TNS) and self-employed agricultural workers.

> Payment plans

These can be concluded between employers and the social security organisation if the contributor :

- Owes at least €1,200 to the tax authorities and social security bodies as of March 2021;

- Does not have any debt (contributions and late penalties) before March 2020;

- Is not subject to a collective procedure as provided for in articles L.620-1, L.631-1 and L.640-1 of the French Commercial Code.

- For claims prior to 15/03/2020, for which an enforceable title has been issued, a separate settlement plan may be concluded. This settlement plan may also take into account claims due from 01/01/2021 until the last day of the month following the end of the state of health emergency.

- Clearance plans can be spread over a maximum of 3 years.

> Partial remission of debts

- Are up to date with their reporting obligations;

- Have suffered a drop in turnover of at least 50% during the period from 01/02/2020 to 31/05/2020 or during the period from 15/03/20 to 15/05/2020 compared to the same period in 2019 * ;

- Attest to particular economic difficulties that make it impossible to meet the deadlines of the above-mentioned repayment plan;

- Attest that they have requested a payment plan or debt remission from their creditors.

The application will be made via a dematerialised form made available by the URSSAF and MSA (all supporting documents must be kept for subsequent verification by the organisations).

—————————–

* The decrease in turnover mentioned above is equal to the difference :

- Cumulative turnover achieved during the same period in 2019

or - Average monthly turnover in 2019 reduced to 4 or 2 months according to the choice made above

or - For companies created between 01/02/2019 and 01/01/2020, the average monthly turnover over the period between the date of creation and 31/01/2020 reduced to 4 or 2 months according to the choice provided above

or - For natural or legal persons (for the manager) having benefited from a sickness, work accident or maternity leave between 01/02/2019 and 31/05/2019 in relation to the average monthly turnover over the period between 31/05/2019 and 31/01/2020 assessed over 4 or 2 months according to the choice provided above

or - For companies created after 01/01/2020 and before 10/03/2020, the loss of turnover is defined as the difference between the turnover achieved between 15/03/2020 and 15/05/2020 and the turnover achieved between the date of creation and 15/03/2020, averaged over 2 months.

—————————–

Please note that when applying for the rebate:

- Employers must be up-to-date with their employee contributions;

- For self-employed workers, the remission will relate to the sums still owed in respect of contributions for 2020.

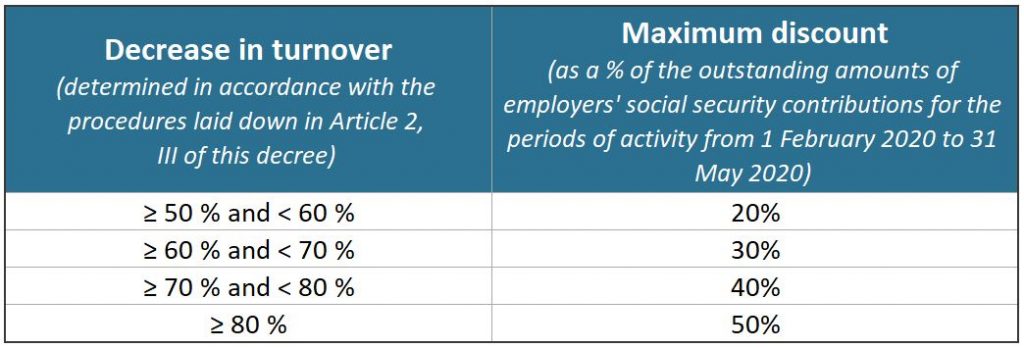

For private sector employers:

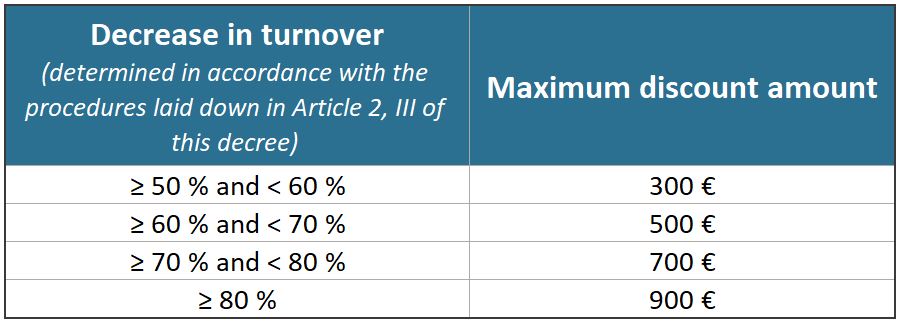

For all self-employed workers:

If you have any further questions, please do not hesitate to contact us!