In the management of a company, the company representative occupies a key position, often carrying with it several responsibilities and various forms of compensation.

In French companies, the compensation of the company representative may fall under several statuses: corporate officer, employee, or shareholder. When a company representative also performs technical duties, the question of combining corporate office and employment contract becomes central. This choice has significant legal, tax, and social consequences.

This overview will help you understand the differences between these types of compensation and determine the best option based on the company’s status.

What is a corporate officer?

A corporate officer is a natural or legal person who carries out managerial, administrative, or representative duties within a company, appointed by its shareholders. This role may be held by the President or CEO of an SAS/SASU, or by the Manager of an SARL/EURL. The officer’s primary responsibility is to make strategic decisions and supervise the company’s daily operations.

Corporate officers are not automatically considered employees of the company within the meaning of the Labor Code, which has a direct impact on their compensation and social security coverage.

Their obligations and responsibilities are governed by specific rules of corporate law.

Corporate Officer Compensation: What Are the Options?

A corporate officer may receive several types of compensation, but not all of them are subject to the same tax and social security conditions. Here are the main possibilities:

1. Compensation for corporate office:

- The executive is paid only for carrying out his management duties (President, CEO, Manager, etc.), without any associated working hours.

- Their compensation is determined by a resolution of the General Meeting, a regulated agreement, or the company’s bylaws. It may be fixed or variable.

- This income is subject to social security contributions (social security, pension, etc.) and is not eligible for social security reductions.

- His work is not covered by labor law. He will therefore not be entitled to paid leave, overtime pay, severance pay, etc.

- No unemployment cover is provided.

2. Salary under his employment contract:

- A manager may combine his corporate office with an employment contract, provided that this contract covers technical duties that are separate from his managerial role. Labor law requirements must be complied with (monthly salary, paid leave, working hours, etc.).

- This type of employment contract implies a relationship of subordination. It is characterized by the following elements:

- The employee receives technical instructions

- The employee is integrated into a structured department

- The employee reports to a line manager

- The employee may be subject to disciplinary action in case of misconduct

- In the event of combining the employment contract with a corporate mandate, the individual will be eligible for unemployment insurance and reductions in social security contributions only after the France Travail questionnaire has been validated.

- The employment contract must clearly define tasks and responsibilities that are separate from those related to company management.

3. Dividends and benefits in kind:

- As a partner or shareholder, an executive may also receive dividends from the company’s profits.

- He may also receive benefits in kind (such as a company car, company housing, or a company savings plan). As these benefits are considered part of his remuneration, they are subject to social security contributions.

Key Differences in Compensation and Legal Status: SAS/SASU vs. SARL/EURL

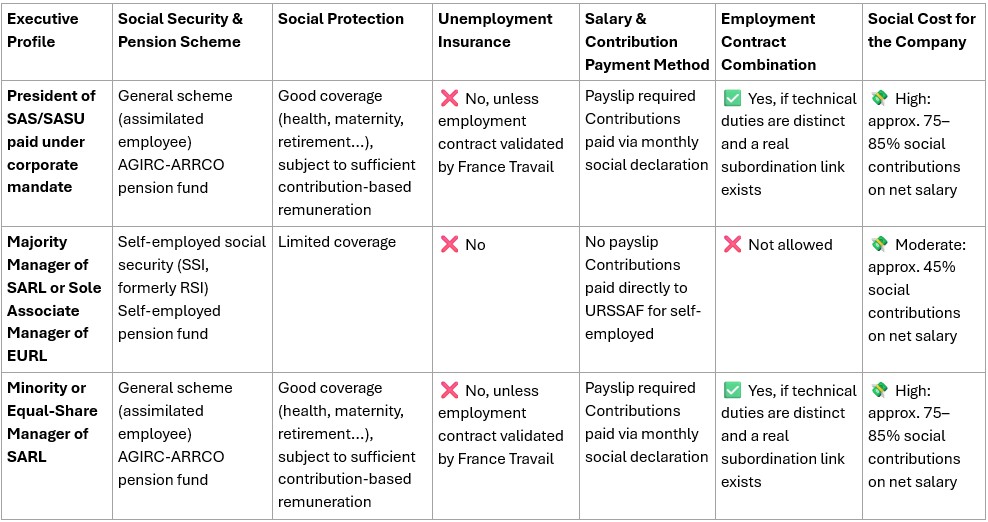

Managers of SAS/SASU and SARL/EURL companies are not all subject to the same social security schemes. Understanding these differences is essential for optimizing both the executive’s remuneration and social protection.

That’s why we’ve provided the summary table below, comparing the main types of compensation across the most commonly established company structures in France:

When a corporate officer is also a shareholder in the company, they may receive part of their compensation in the form of dividends.

Dividends received by shareholders of an SAS/SASU are never subject to social security contributions, regardless of their amount. They are only subject to:

- 30% flat tax (PFU): 12.8% income tax + 17.2% social taxes,

- Or, optionally, under the progressive income tax scale (after applying a 40% allowance under certain conditions), along with social taxes of 17.2%.

However, dividends received by majority managers of SARL and sole shareholders of EURL subject to corporate income tax are liable for social security contributions when the distributed amount exceeds 10% of the company’s share capital, share premiums, and funds paid into the shareholder’s current account.

- Below the 10% threshold: Only the flat tax (or the progressive income tax option) applies—no self-employed social security contributions (TNS).

- Above the 10% threshold: The excess portion is included in the base for TNS social security contributions, which in turn entitles the shareholder to additional social benefits (such as health, maternity, and retirement coverage).

Practical conditions for the executive to benefit from adequate social protection

Under the general social security scheme, for the coverage to be effective and for the executive to benefit from its advantages, the following conditions must be met:

- Contribute based on 150 times SMIC, the minimum wage in France (i.e., €7,128 gross in 2025) to validate four retirement quarters within a calendar year.

- Receive a net taxable salary of at least 20% of the Annual Social Security Ceiling (PASS) over a calendar year (i.e., €9,420 in 2025) to benefit from the French social security system and avoid paying the PUMA (universal health coverage) supplementary contribution.

- Have contributed during the six calendar months preceding a work stoppage on a salary equal to at least 1,015 times the hourly minimum wage (SMIC) to qualify for daily sickness benefits (IJSS) from the social security system in the event of illness-related leave (i.e., €12,058.20 gross over six months in 2025).

For a majority manager of a SARL or a sole shareholder of an EURL (subject to the self-employed social security scheme – TNS), basic social protection is less comprehensive and less costly than that of an employee under the general scheme. However, to compensate for this limited coverage, it is possible to take out supplementary insurance contracts (health, disability, retirement), most of whose contributions are tax-deductible under the Madelin Law.

Conclusion: Choosing the Right Compensation and Corporate Structure

The choice between a corporate mandate and an employment contract for technical duties goes beyond compensation. It also determines the executive’s social protection, the cost for the company, and future entitlements (such as health coverage, retirement, and unemployment benefits).

It’s important to remember that the company’s legal structure (SAS, SASU, SARL, EURL, etc.) directly influences the executive’s social status:

- In an SAS/SASU, the president is always considered an assimilated employee, benefiting from broader social coverage—but with higher social contributions.

- In a SARL/EURL, the manager’s status depends on whether they are the sole shareholder, majority shareholder, or hold equal or minority shares, with varying levels of contributions and protection.

Moreover, in small companies, it is often very difficult to justify a genuine relationship of subordination between the executive and the company—even when the executive performs clearly distinct technical duties. In practice, this makes it rarely possible to consider the executive as an employee under the French Labour Code, which complicates access to unemployment benefits and eligibility for reduced social contributions.

In summary, before even discussing compensation, it is crucial to anticipate the company’s legal form, the executive’s status, and then weigh the trade-offs between cost, social protection, and managerial flexibility. It is essential for executives to fully understand these differences to make the most appropriate choice for their social and tax-related needs.

French Business Advice supports you in making strategic decisions with a comprehensive range of services:

- Legal: guidance on choosing the right company structure, drafting articles of association, and handling formalities.

- Accounting: bookkeeping, financial optimization, and tax advisory.

- Social: ayroll management, executive social protection, and support in cases of combined corporate mandate and employment contract.

We can help you make secure, well-informed decisions while optimizing your compensation and social protection.