As of January 1, 2022, the legal training contributions of employees must be paid to the Urssaf and the frequency of payments has changed.

This reform is accompanied by the modification of certain rules, in particular concerning the exemptions applicable to these contributions.

> Payment of 2022 contributions on the same dates as social security contributions

This concerns the CPF-CDD contribution, as well as the Cufpa (contribution to the professional training of employees, and apprenticeship tax for the main part).

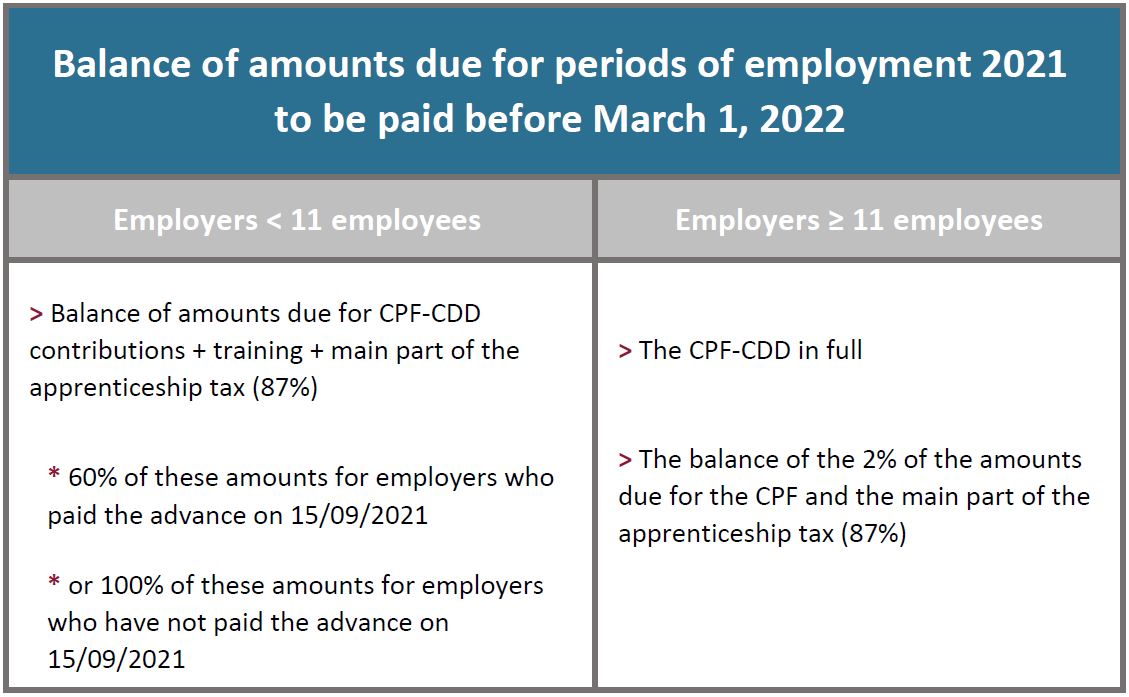

> Payment of contributions due for 2021

During the first quarter of 2022, employers will have to pay the balance of the sums due for the periods of employment in 2021 in addition to those due for the first months of 2022.

> Attention to the additional payment of the balance of the apprenticeship tax

An intermediate balance of the apprenticeship tax has been created, calculated on the 2021 payroll. The payments must be made to the authorized training organizations before June 1st, 2022.

The balance of the apprenticeship tax calculated on the 2022 payroll will be paid to Urssaf at the time of the DSN of April 2023.

Do not hesitate to contact your payroll manager in charge of your file!